Way back in 1955 the then chairman, William McChesney said that

the Federal Reserve “is in the position of the chaperone who ordered the punch bowl removed just when the party was really warming up.” But it was done because there are economic danger signals in sight. “If we fail to apply the brakes sufficiently, and in time, we shall go over the cliff.”

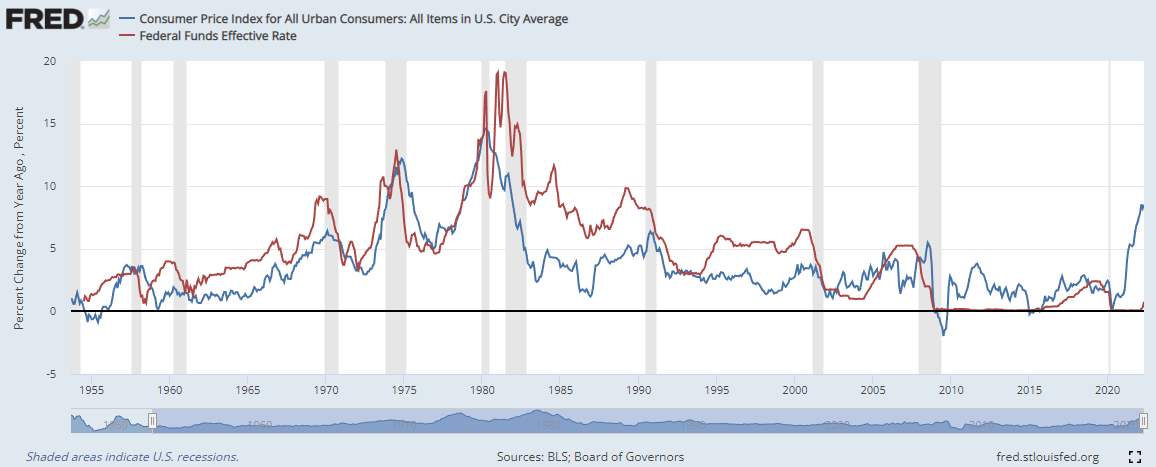

When he took office that year the Fed funds rate was 1.4% and inflation was minus 0.37%, When he left office in 1970 inflation had risen to 7% and he had jacked rates up to 9.6%. The removal of the punchbowl (higher rates) helped inflation back down again to circa 3% by 1973. The effect of raising rates also caused the 1970 recession.

The 1973 oil shock pushed inflation to 12% by 1975 with the Fed funds rate peaking at 13%. We then had the build-up of the inflationary spike in the latter half of the 70s until Paul Volcker was appointed Chairman in August 1989. At that time interest rates were already at 10.5% and he immediately took the punch bowl away and raised them to 17.5% which caused a 6 month recession between January and June 1980.

He then lowered rates to 9.5%, but inflation was not done and rose to 14% so the punch bowl was again removed, and the rate went as high as 19%. That killed inflation, which bottomed at 2.5% in August 1983, but also the economy which went into an 18 month recession. By the low point for inflation the Fed funds rate had fallen, but only to 9.5%.

From then on inflation never got above 6% (1990) and rates meandered lower and for 40 years we enjoyed a low inflation high growth environment. Things have changed and we are now back to grappling with inflation something very few of us have actually experienced. The other, perhaps for some of us, more memorable event in 1970 was the release of the Carpenters’ hit single, “We’ve only just begun” and that is where we find ourselves now in the quest to conquer the insidious rise and rise in prices. People are slowly getting to grips with the consequences of inflation, but we suggest it still has a long way to go.

US CPI v Fed Funds rate

What really stoked inflation in the 70s was wage push driven. Wage rises were expected and for some time that’s what we got until Volcker turned up at 33 Liberty Street. We are beginning to see that again now and as people find their nominal wages are increasing the tendency is to carry on spending as tomorrow prices will be higher i.e. your spending power will be diminished if you don’t. In a deflationary environment we have the polar opposite. People save their money so as to buy things at a cheaper price later on; something Japan struggled with for over 20 years and is still not completely “out of jail” even now.

In the early stages of inflation, especially in the current case where there is also a shortage of supply, buying proceeds apace which just adds to demand and prices carry on rising. This gives the impression that the consumer is strong, but, in reality, savings are being drawn down and as that source of spending runs out credit cards get maxed out. There will come a point when inflation in the price of necessities, shelter, food, light, heat and transport reduces spending power to buy other “stuff”, i.e., we get a recession.

Central banks are on a mission to “defeat” inflation using the only tool they have i.e., interest rates, which will eventually kill off demand, but won’t solve the supply issue. The one area where they are hoping (hope is never a good strategy…) for some help is lower oil prices; another double edged sword. Lower prices can arise as the economy moves towards recession (driven by higher rates) and demand for oil from industry and the transport sector diminishes. The other option, which flies in the face of the green lobby, is to increase supply.

The reason Biden is travelling to Saudi Arabia in July (13th to 16th) is to ask, plead, bribe MBS to pump more oil which in theory should bring the price of oil down. What would be even more effective would be for him to hold a press conference in the US with the CEOs of the top 10 oil companies and announce that in this emergency in which we find ourselves we have agreed with the oil companies, as a temporary solution to do everything we can to increase US oil output, which will drive down the price of oil and cut off the life blood to the Russian economy.

West Texas Intermediate Oil

This won’t happen for two reasons; the aforesaid green lobby and having to admit that sanctions don’t work. If he can get the Saudis to pump more and we see a meaningful fall in the oil price, say to $80 which is where it was pre Ukraine, then we will start to see inflation falling, in rate of change terms, which may give the Fed a chance to at least pause in carrying out their hawkish interest rate policy. That would certainly go down well with the markets, but it doesn’t solve the supply side problem, so inflation may still be an issue; the same issue Volcker had.

Even if inflation were to fall to the 4%-5% range then rates would need to have been above that level to get it back down there and we may well have two recessionary periods a la Volcker or perhaps an extended one which is not in the current economic thinking.

Who’d be a central banker or a POTUS….So let’s hope the oil price bails them out😎