The Bank of England has produced the gloomiest (most realistic?) report on growth and inflation in their entire history.

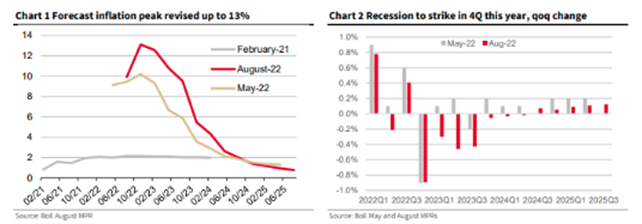

CPI, which last month was 9% and change, is forecast to go above 13% in the current quarter which they then assume will be the peak and it will not be until the end of 2024 that they expect it to reach their hallowed 2% target. The peak in inflation is not far off especially as the commodity complex, including agricultural commodities, important for food price inflation, have fallen markedly since the peaks of early summer and in many cases are now below the levels just before the Ukraine invasion, which is universally blamed for any bad news especially inflation! Gas prices remain the exception which is not good for Europe in particular and supply chain issues are still responsible for the majority of price increases, which will still be an issue, even as demand falls.

On top of that the BoE believes that we will be in recessionary mode all the way through 2023

.And the FTSE went up! The argument being that 80% of FTSE100 revenues are sourced abroad and with sterling weak they become more attractive especially to foreign buyers. No one seems to be watching the trends in global GDP; Europe and the US in particular.

Fund managers are telling us that things are still “OK” and results for Q2 were mixed to pretty reasonable, but many are citing an unknown outlook, which the BoE has just confirmed.

Anecdotally one of our local bus companies has gone into receivership, the Bournemouth Yellow Bus company; not quite as ubiquitous as red London buses, but an important part of the local transport network. Our picture framing shop has closed, the owner saying that after it became apparent that gas and electricity prices were going to be significantly higher people have stopped spending. This, he says, has happened suddenly in the last 6 weeks. Also, again on a small scale, a local designer shoemaker has also given up the challenge. Discretionary spending is very much coming under pressure.

The usual response to such bad news is that it is already priced in, but analysts are only just beginning to revise earnings numbers down and very few have witnessed a prolonged recession which will necessitate significantly lower earnings estimates. As is often the case they herd together and are behind the curve – following the lead from the BoE who “should” have raised rates much earlier.

Same story in The US and Europe; central banks are hoping that 50/75bps rate rises will do the trick as the position of government finances (huge debt burden) precludes Volckeresque measures. He didn’t mess round and raised rates by 5% all in one go. That stifled demand pretty quickly, so he lowered them again by 5% only for demand to pick up once more so he had to hit the 5% button again. This is the issue with much talk of Fed pivoting in that if they do it too early demand will again pick up and they will eventually have to pivot back. A very good definition of being between a rock and a hard place.

Inflation expectations as indicated by the 5yr5yr forward inflation expectations are skewed to the downside by the actions of the Fed that owns over 25% of the TIPS market in the US. We expect the inflation rates in the US and Europe, to follow a similar path to that set out above by the BoE.

Equities – US - growth stocks have made up a significant amount of the prior falls but are still expensive and we believe we are in the process of a bear market rally potentially with much lower prices to come.

Equities – Europe UK Japan – none of them look heroically expensive but the potential for significant downgrades does not make them cheap either. Value is the preferred option as value stocks tend to perform better in a rising rate environment. Why is that? The better run value companies haven’t taken on the debt levels that growth stocks have “enjoyed”. Notably the growth stock debt increases have not been predominately for capex, so they have a higher interest rate bill with little to show for it.

Equities - Emerging Markets and China – when we finally get prolonged dollar weakness the EMs will be a strong option. China has flattered to deceive with continuing issues in the property and banking sectors plus a general slowdown in global growth has knocked the shine off the Chinese equity market. War games over Taiwan are not helping either are they?

Bonds – in a recession with demand destruction via higher short term rates, longer duration US Treasuries are looking good value. High yield on the other hand will be disadvantaged by a corporate earnings recession. Yields there do look cheap but look where we have come from. These are spreads over USTs.

Source FRED

Alternatives – Gold – beginning to get some traction but we may have another leg lower before a significant upside move.

Alternatives – trend following and long volatility – they don’t feature in many portfolios; much misunderstood, but both options worth considering - so do your own homework!